2025 Southern California Multifamily Market Outlook: Key Insights for Investors

2025 Southern California Multifamily Market Outlook: Key Insights for Investors

JPMorgan Chase's April 2025 multifamily market update offers a comprehensive analysis of the Southern California real estate landscape, highlighting trends and opportunities in Los Angeles, Orange County, and San Diego.

Los Angeles: Resilience Amid Challenges

Despite the January 2025 wildfires affecting over 18,000 structures, Los Angeles' multifamily market remains robust. Vacancy rates are projected to stabilize at around 4.4%, below the national average of 6%, with asking rents expected to rise by 2.3% year over year. The city's diverse economic base continues to support housing demand, even as the full impact of the wildfires is still being assessed.

Read more about the Los Angeles outlook

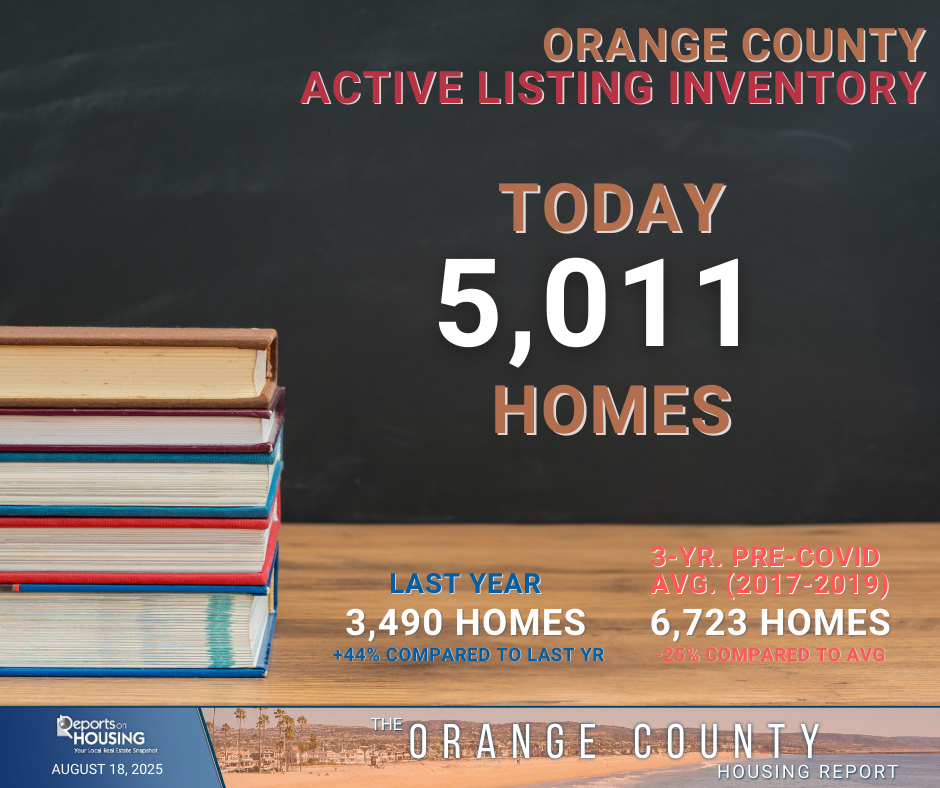

Orange County: Strong Demand for Workforce Housing

Orange County's multifamily sector is experiencing strong demand, particularly in the workforce housing segment. With low vacancy rates and a high home price-to-income ratio, rental demand remains high. The Irvine Business Complex is a focal point for new development, supported by relaxed zoning laws permitting up to 15,000 high-density residential units over the next two decades.

Explore more insights on Orange County

San Diego: Stability and Growth Opportunities

San Diego's multifamily market is characterized by stability and growth. Vacancy rates are holding steady at 4.5%, significantly tighter than the national average. Asking rents are projected to rise by 2.5% year over year. The city is also seeing a surge in construction, with over 2,800 new apartments expected, addressing the ongoing housing demand.

Accessory Dwelling Units (ADUs): A Strategic Opportunity

Across Southern California, the addition of Accessory Dwelling Units (ADUs) presents a viable strategy for property owners to increase cash flow. ADUs, such as detached units or converted garages, are in high demand due to the region's housing shortage. While they require an upfront investment and navigation of regulations, the potential for additional rental income makes them an attractive option.

Click below to dive deeper into the full market update — and if you’re an investor looking to stay ahead of the curve, email Danae to be added to her VIP Investor Buyer List.

📖 Read the full JPMorgan Multifamily Market Outlook – April 2025

Categories

Recent Posts